New Staking Coins to Watch: Emerging Cryptocurrencies for Passive Income

Staking altcoins has appeared as a favorite approach for cryptocurrency investors to generate rewards while promoting blockchain networks. Unlike old-fashioned proof-of-work programs that rely on mining, sui staking requires individuals securing up their coins to validate transactions and keep system security. This technique not just advantages the system but in addition offers many benefits to stakeholders.

Knowledge Staking in Altcoins

Staking altcoins entails keeping a quantity of cryptocurrency in a designated wallet to aid the operations and safety of the blockchain. This technique on average requires participating in a proof-of-stake (PoS) or delegated proof-of-stake (DPoS) agreement process, wherever stakeholders are selected to validate transactions on the basis of the number of coins they maintain and stake.

Returns of Staking Altcoins

1. Getting Inactive Revenue:

One of the primary attractions of staking altcoins is the capability to make inactive income. By staking their coins, investors may receive benefits in the shape of additional altcoins. These rewards are distributed regularly, giving a constant income stream that may complement conventional expense portfolios.

2. Network Protection and Participation:

Staking altcoins represents an essential position in sustaining system security and decentralization. By sealing up coins in a staking budget, members donate to the consensus system that validates transactions and obtains the blockchain. This effective participation helps prevent episodes and ensures the strength of the network.

3. Developing Governance Rights:

Several staking standards grant players governance rights within the network. Token cases may possibly have the opportunity to election on proposals that influence the blockchain's development, such as process improvements, cost modifications, or environment expansions. This democratic strategy empowers stakeholders to form the ongoing future of the platform.

4. Prospect of Money Appreciation:

Beyond making staking returns, keeping altcoins for staking applications can potentially cause capital appreciation. As more investors be involved in staking and demand for the altcoin grows, its market value may possibly increase. That double advantage of making rewards and potential price understanding promotes the entire get back on investment.

5. Incentives for Long-Term Holding:

Staking altcoins encourages long-term keeping among investors. Sealing up coins in a staking wallet usually needs a commitment over a certain time, incentivizing stakeholders to aid the network's balance and growth. That aligns with the cryptocurrency ethos of marketing decentralized ecosystems.

Criteria Before Staking Altcoins

1. Risk and Volatility:

Cryptocurrency markets are noted for their volatility, and staking altcoins provides inherent risks. Cost fluctuations, scientific challenges, and regulatory improvements can impact the worthiness of staked coins and potential rewards. Investors must assess their chance threshold and diversify their portfolios accordingly.

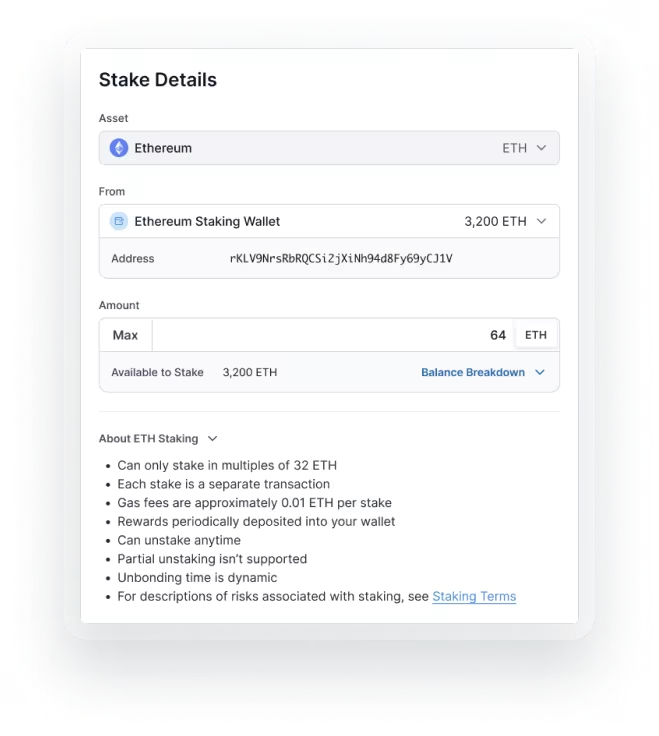

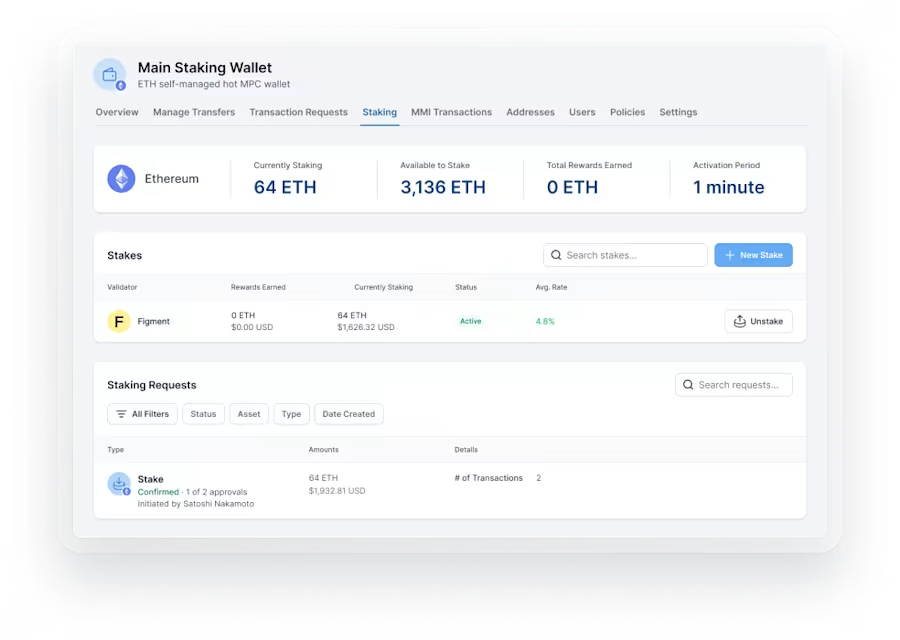

2. Staking Demands and Problems:

Each staking process might have particular needs and situations for participation. These could contain minimum staking quantities, lock-up periods, and technical familiarity with managing electronic wallets. Understanding these demands ensures conformity and effective participation in staking activities.

3. Returns Structure and Earnings:

It's necessary to analyze and realize the returns structure of staking altcoins. Different methods provide varying prize costs, circulation frequencies, and systems for calculating returns. Assessing potential earnings against associated dangers helps investors make informed decisions.

4. System Safety and Consistency:

Assessing the protection and reliability of the blockchain network is critical before staking altcoins. Facets such as for instance network uptime, record of protection incidents, and the protocol's resilience against possible attacks provide ideas into their trustworthiness and detailed stability.

5. Long-Term Investment Technique:

Investors should align their staking activities with their long-term financial objectives and cryptocurrency expense strategies. Whether staking for passive income, promoting system development, or participating in governance, having a clear program may enhance returns and mitigate dangers around time.

Realization

Staking altcoins gift ideas an chance for cryptocurrency investors to make benefits, support blockchain sites, and be involved in governance decisions. However, it's necessary to method staking with a thorough comprehension of their benefits, dangers, and working requirements. By considering these facets and aiming staking activities with long-term investment goals, investors can understand the changing landscape of cryptocurrencies effectively.